Business

The 2017 M&A Fee Guide

Data and insights on fee structures from over 470 investment bankers and M&A advisors.

It’s natural enough to wonder how other advisory firms in your industry are structuring their M&A fees. It can be a challenge to know what rates to charge because the subject of M&A fees is rarely brought up in the open. To promote transparency in the market, Firmex and Divestopedia have collected data from over 471 investment bankers and advisors globally.

Their report reveals interesting facts about M&A fees by region, success fees structures, transaction values and purchase price included in success fees calculation.

- Success fee by regions

Success fees are usually paid to the investment bank after they successfully close a deal. This cost is a calculation of the total value of the contract. The report by Divestopedia and Firmex revealed that different regions and cities have different success fee rates. This underscores the need for advisors and investment bankers to think locally, and not just rely on the national averages.

To delve in more in-depth, respondents from the US Pacific indicated that a $50 million deal attracts success fees of 2-4%, while respondents from the Northeast said that the same agreement would attract success fees of between 1-2%.

- Buyer’s and seller’s interests

The report also found out that investment bankers and advisors favour success fee structures that reward both parties with a higher total deal value. According to the research, 45 % of players in the market used a scaled success fee structure to take care of the interests of both the banker and seller.

- No industry standards of purchase price.

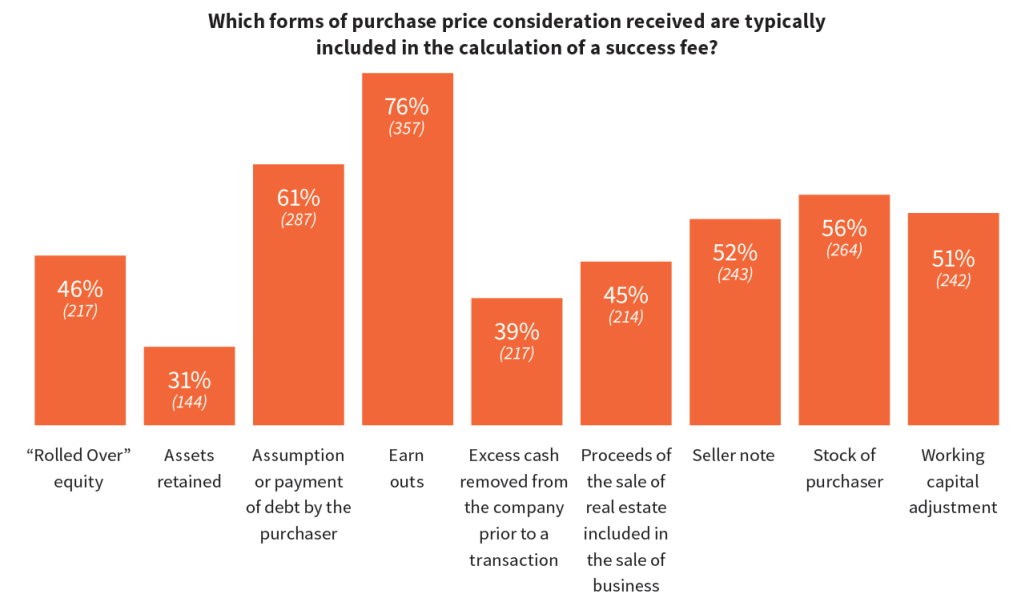

Another thing, the finance report laid bare the fact that there is no unison in the industry over what makes up the purchase price upon which success fees should be calculated. Similarly, there is no unanimity on the timing when to pay success fees. Nevertheless, the report found out that 67 % investment bankers and advisors included earn outs in their calculation of success fees.

Smaller transaction deals incur higher success fees percentages. Many clients, however, get into monthly engagement fees to reduce the impact of big success fees rates.

What this information means

This information can help businesses to understand what M&A fee structures entail. They can understand what fees will be charged, how and for what. Business owners now have the power to determine the most appropriate prices when hiring investment bankers and M&A advisors.

For M&A practitioners, this information levels the playing field. Usually little or no information about fees slips up in conversations between rival investment bankers and advisors. From the report, it is easy to infer what players in your region are charging, so that you can meet the market expectations of your clients.

M&A practitioners can choose to share this report with their clients just to demonstrate transparency and accountability. This finance report is the evidence you can use to support the fees structure proposed in your M&A deal.

By and large, information from this report can prove beneficial in negotiating fees and terms in an M&A transaction. It is important to note however that a favourable M&A deal primarily relies on the efficiency of the M&A advisor/banker. It all comes down to the advisor/banker’s effort to ensure that either party’s interest is taken care of.

Download Full Report: https://www.firmex.com/resources/ma-fee-guide-2017/